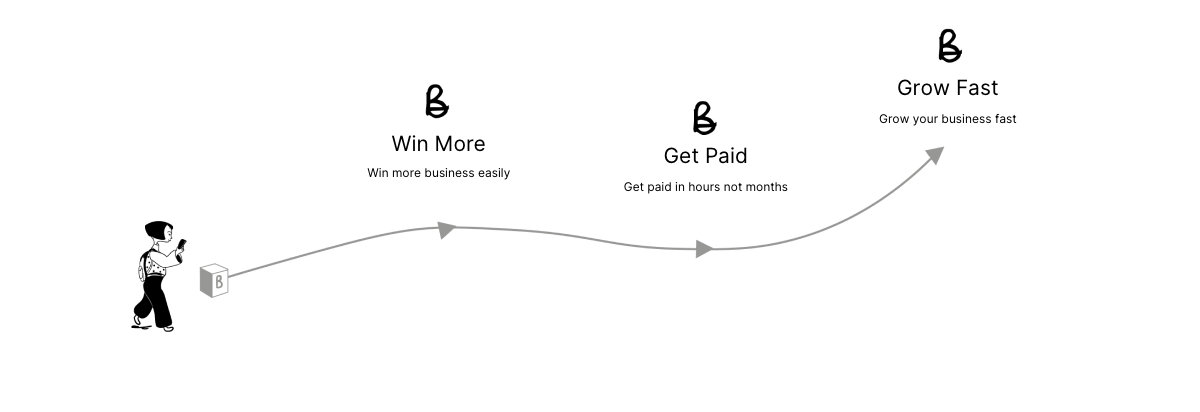

Win business, get paid, grow fast

Bullet is your new business toolkit, everything you need to kick-start and grow your startup in one place.

"extremely user friendly"

"perfect for small teams"

"everything’s just automated"

Everything your startup needs

Bullet powers your startup with a comprehensive suite of integrated tools - accounts, invoices, receipts, payroll, tax returns, reports, proposals, projects, and chat - all full products, connected and consolidated in one convenient location.

Be in control as your business grows - on the web, on iOS, and on Android.

One integrated suite of products

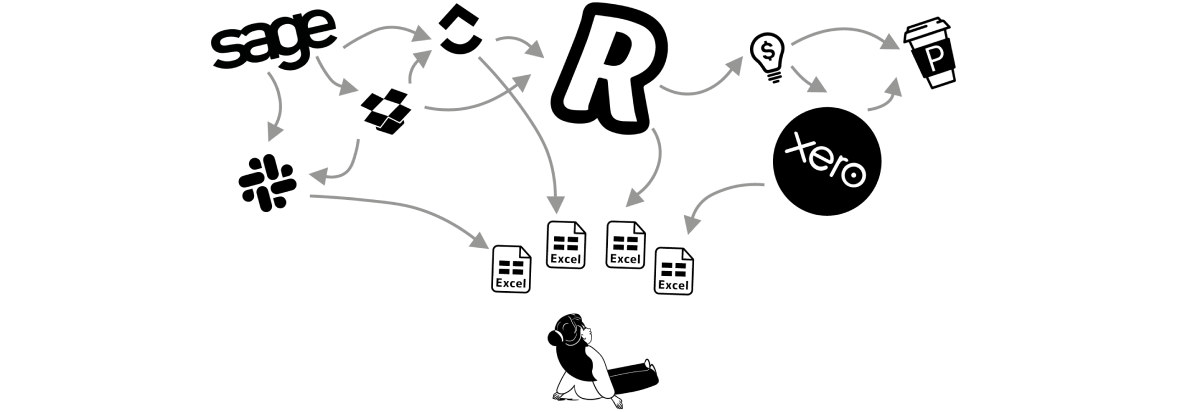

Starting a small business can be chaotic, with data spread across dozens of apps, Post-it notes used to for passwords, and still, it’s a challenge to see what’s working.

Bullet propels your business forward with an all-in-one toolkit designed to help you win business, manage payments, and grow your dream.

Save €9,181 per year

Bullet replaces a bunch of apps. See how our all-in-one fixed-price app compares to bundling 8 apps together.

Bullet

€49/month per person

- Accounts & Payroll

- Projects

- Business Account

- Proposals

- Chats & Com’s

- Receipts

- Storage

Bullet is: €2,940 a year for 5 users

€588 a year for 1 user

Xero: Accounting

€65/m per user

Sage: Payroll

€10/m per user

Click Up: Projects

€19/m per user

Revolut: Account

€100/m per user

Proposify: Proposal

€49/m per user

Slack: Chats & Com

€15/m per user

Dext: Receipts

€53/m per user

Dropbox: Storage

€15/m per user

Bundle is: €12,121 a year for 5 users?

€5,580 a year for 1 user

Everything to grow your startup

Highlights of your new business toolkit

Win business

Stand above the crowed with winning proposals that pop.

Streamlined Proposal Creation

Generate professional, persuasive proposals quickly.

Use customisable templates that reflect your brand, stand out and win clients.

Integrated Project Planning

Seamlessly transition from proposal to project,

ensuring you're ready to kickstart work as soon as the client says 'yes'.

Real-time Client Engagement

See when you’re clients engage with your proposal.

Instantly see when invoices are read, and when you’ve been paid.

Get paid

Every tool you need to get paid in 5 days not 90.

Instant Payment

Use proposals or invoices to capture bank details,

bring pay terms down from 90 days to 5. Stop chasing money

Simplified Payment Processing

Offer multiple payment options and easy invoice payments to reduce friction,

ensuring you get paid faster.

Effortless Financial Management

Keep track of your earnings with an intuitive accounting system.

With accurate billing and integrated expense tracking.

Grow fast

Run projects the smart way, and grow your business without stress.

Streamlined Payroll Systems

Automate and manage payroll with ease,

allowing you to scale your team quickly.

Project Scalability

With tools to manage multiple projects efficiently,

take on more work and bigger clients, growing your business at a faster pace.

Enhanced Team Coordination

As your team grows, maintain clear communication channels that help manage

and scale operations efficiently.

500,000 small businesses use Bullet tools

“We were getting started. I knew getting paid from customers could take 90 days. Bullet fixed that with next day payments.”

“We were getting started. I knew getting paid from customers could take 90 days. Bullet fixed that with next day payments.”

Mark Morgan, Design Up

“Every small business should start with Bullet. Everything you need.”

“Every small business should start with Bullet. Everything you need.”

Suzanne Boyce, West East Interiors

“The proposal tool is just designed to win business.”

“The proposal tool is just designed to win business.”

Lisa Thompson, Ink Studios

“All their small business tools are full solutions. You’ve everything you need to start and grow your startup.”

“All their small business tools are full solutions. You’ve everything you need to start and grow your startup.”

David Collins, Monday

“Thank you, Thank you, Thank you Bullet.”

“Thank you, Thank you, Thank you Bullet.”

Joan Crawford, Bong Bong